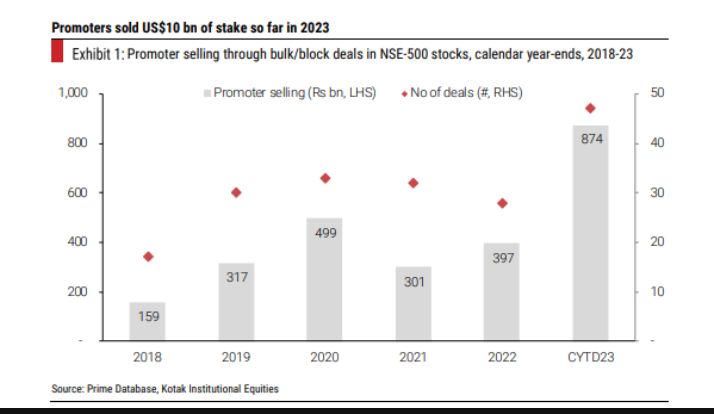

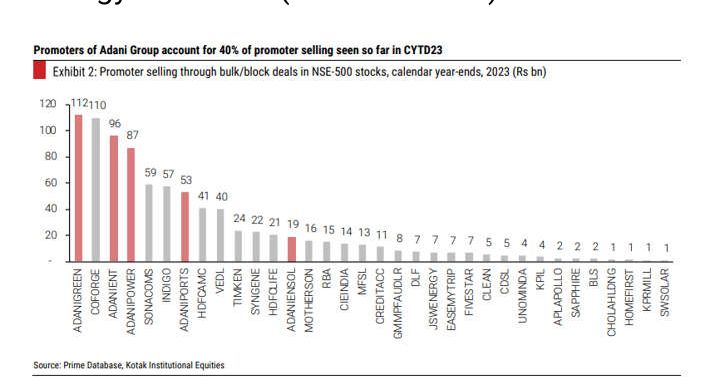

Promoters reached the $10 billion threshold in Calendar 2023, the greatest level in six years, mostly as a result of strategic imperatives. According to a Kotak Institutional Equities study based on bulk and block deal data, promoter selling so far in 2023 is actually two times that of calendar year 2022. According to the brokerage, 40% of all promoter sales in the NSE500 index were made by Adani group firms such Adani Green Energy Ltd, Adani Enterprises Ltd, Adani Power Ltd, Adani Ports & SEZ Ltd, and Adani Energy Solutions Ltd.According to Kotak, proprietors of NSE500 businesses sold over Rs 87,000 crore worth of shares in 2023, including a staggering Rs 37,000 crore worth of shares sold by Adani Group company promoters.

Only a small amount of promoter sales, according to Kotak, will be attributed to the current strong stock market environment. According to the report, a large amount of the sales made by promoters go to their holding firms, which raise money “to manage high purported debt in promoter holding companies (Adani Group companies, Vedanta),” according to the report. According to Kotak, another significant chunk is attributable to one of the promoters leaving a business, as happened with HDFC Life and CIE India for strategic reasons (portfolio rationalization).

The majority of promoter selling so far this year has been concentrated in the capital goods, electric utilities, IT services, and transportation sectors, while insurance and IT services accounted for the majority of promoter selling from 2018 to 23,” it was stated.

According to Kotak, promoter holdings in the BSE200 index decreased from 50.3 percent at the end of the December quarter to 48.8 percent in the June quarter as a result of promoter sell-downs. In contrast, according to the firm, domestic investors’ aggregate holding rose by 90 basis points to 23.5% in the June quarter.

Over the same time period, the holding of FPIs has grown very modestly, by 26 bps, to 21.7%, while the holding of others—including AIFs and PMS—has grown by 31 bps, to 6%. It’s fascinating to see how ownership patterns have changed in businesses that have had significant promoter and PE sell-downs.